🏡 Mortgage Payments Are Easing – What January’s Figures Mean for Buyers & Sellers in Herne Bay and Whitstable

If you’ve been waiting for affordability to improve, the latest mortgage snapshot suggests things are moving in the right direction. New analysis published by Rightmove shows that the average monthly mortgage payment in January was lower than a year ago, helped by reduced mortgage rates and relatively modest house price growth.

📉 The Headline: Monthly Payments Down Year-on-Year

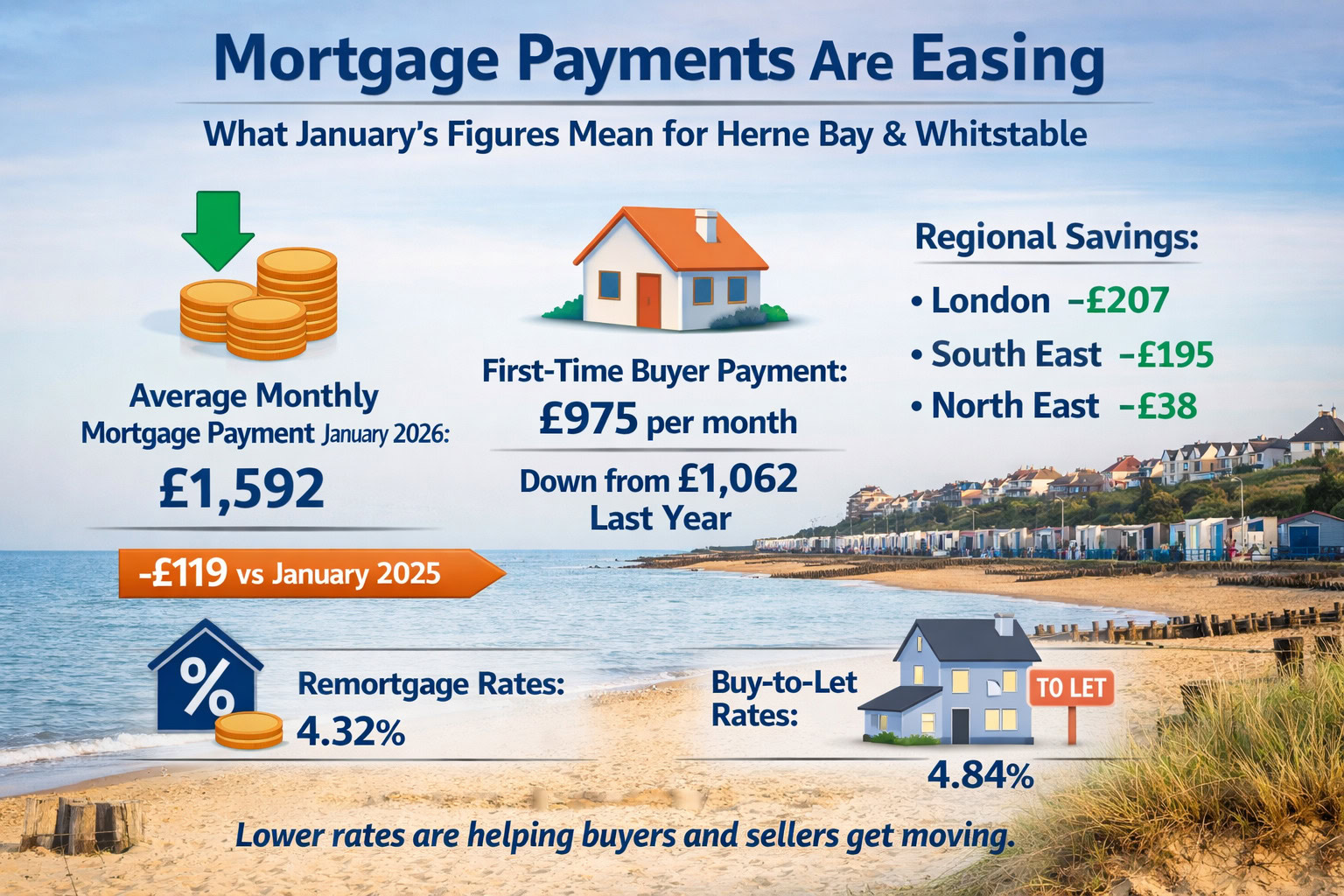

Rightmove reports that the national average monthly mortgage payment was £1,592 in January 2026 — which is £119 (7%) lower than January 2025, even though the average price of a home rose slightly over the year. This is largely down to cheaper borrowing costs compared with last winter.

- Average monthly mortgage payment (Jan 2026): £1,592

- Change vs Jan 2025: -£119 (-7%)

- Average 2-year fixed rate (Jan 2026): 4.23% (down from 4.99% a year earlier)

- Average asking price (Jan 2026): £368,031 (up 0.5% year-on-year)

📆 A Small Catch: January Was Slightly Higher Than December

While payments are down compared with last year, Rightmove also notes that the typical monthly payment in January was around £35 higher than in December 2025. The reason is simple: asking prices jumped month-on-month, so the loan size many buyers need has increased slightly.

In December 2025, the national average asking price was £358,138, which is notably lower than January’s figure.

👀 First-Time Buyers: A Meaningful Drop

For first-time buyers, the improvement is clearer. Rightmove puts the average first-time buyer home at £225,544 in January, with a typical monthly mortgage payment of £975 — down from £1,062 this time last year.

- Typical first-time buyer payment (Jan 2026): £975/month

- Typical first-time buyer payment (Jan 2025): £1,062/month

- Illustrative 20% deposit on £225,544: £45,109

🗺️ Regional Snapshot: Where Savings Are Strongest

Rightmove highlights that the cash saving from lower rates varies by region — mainly because higher-priced areas feel rate reductions more strongly in pounds and pence.

For example:

- London: biggest year-on-year reduction at -£207

- South East: -£195 year-on-year (average monthly payment around £2,000)

- North East: smallest year-on-year reduction at -£38

🏠 Remortgaging & Buy-to-Let: Rates Also Improved

If you’re refinancing, Rightmove says the average remortgage rate in January was 4.32% (down from 5.14% last year). For landlords, the average buy-to-let rate was 4.84% (down from 5.51% last year).

🗣️ What Rightmove’s Mortgage Expert Said

“We saw some headline-grabbing low mortgage rates… dropping to their lowest level since before the mini-Budget.”

— Matt Smith, Rightmove mortgage expert

📍 What This Means in Herne Bay & Whitstable

For our local market, improved affordability usually brings more viewings, more offers, and more proceedable buyers — particularly when first-time buyers feel the difference month to month.

If you’re selling in Herne Bay or Whitstable, this is the sort of shift that can help unlock demand — but pricing and presentation still matter. Buyers may have a little more headroom, but they’re still value-conscious and will compare your home against competing listings.

If you’re buying, the key is to get clear on what you can borrow now (and what rate you’d realistically secure), then move quickly when the right property appears — especially as spring activity builds.