Why You Need A Schedule of Condition: October 2022

Why You Need A Schedule of Condition. In this video we discuss what a Schedule of Condition is and why when you are letting out

Why You Need A Schedule of Condition. In this video we discuss what a Schedule of Condition is and why when you are letting out

In this video recorded on the 8th October 22 myself and our lettings manager, Teresa, share some tips for first time Landlords.

June 2022 Property Market Report Welcome to the June 2022 property market comment. The Jubilee weekend kicked off the summer in style, although from a

Although a good letting agent will of course expect to accompany prospective tenants who want to view your investment, and are trained to maximse the opportunity, there is a lot to be said for you being there too!

For example, a tenant who has met the landlord is much less likely to pay their rent

The archetypal multi-property “professional” landlord probably only accounts for about half of all landlords. The rest come in all shapes and sizes. Which of the following are you?

1. The Accidental landlord

This is a homeowner who would ideally have sold, but has decided to rent instead. Perhaps the market is not strong enough to

The end of the holiday season usually prompts great activity in the rental market and landlords should not only be prepared for this, but also take advantage of it.

The summer holiday not only marks the end of the school year, but also the end of a time of employment, with many people handing in

In an ideal world, once a tenant has been found, it would be good to think that you, as a landlord, can simply sit back and watch your investment deliver the anticipated return on investment without further involvement. Indeed, this is one of the reasons why some letting agents only offer a tenant finding service.

As a landlord you’ll want to minimise the time your property is empty between tenancies (what we call the void period) so it is essential that your property is looking its best for showing to new tenants both in terms of condition and cleanliness.

Although a tenanted property should be redecorated from time to time,

Whilst there are over one hundred pieces of legislation with which a letting agent should be familiar, three come particularly to mind when it comes to advising landlords about the basic responsibility they have to the safety of their tenants, as well as helping landlords avoid a £5,000 fine or six months in prison for non-compliance!

One of the first things a tenant will ask a letting agent when offered a property is “How long has it been available?” – and with good reason. Moving house is a huge event and it takes courage to commit to undertake such a decision – often with very little support other than pure instinct.

Most landlords will recognise the tremendous importance of ensuring that as many prospective tenants as possible see their property. After all, more viewings means more tenant competition thereby maximising your chances of securing the highest rental the market will pay.

However, whilst one always has to be fair, there is a lot to be said

Despite the fact that many people regard letting agents as more or less the same, there are in fact numerous selection criteria on which to judge the good from the bad, and the remarkable from the mildly indifferent.

For example, there are many services and innovations which can make a

The opportunities opened up by technology in the lettings field have been enormous, yet many lettings agents simply use their website as a glorified shop window. Like any agency window, the properties displayed need to be regularly updated and presented in a way that inspires tenants to take things further.

But a good agency website

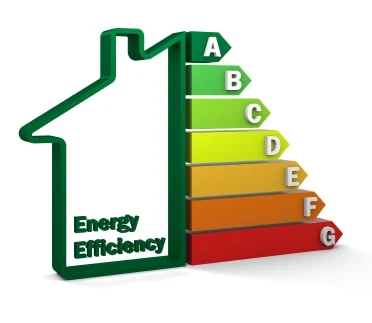

As part of the lettings process, landlords are required to ensure that their property has an Energy Performance Certificate (EPC) available to all prospective tenants (including existing tenants renewing their tenancy) with a minimum performance rating of “E”. This will extend to existing tenancies on 1st April 2020.

An EPC is a certificate issued by

Welcome to the May 2021 Property Market Comment. The cherry blossom is always a reminder of the very peak of spring, and indeed of the annual boost to the property market. Certainly, this year has seen more intense activity than most of us in the property sector can remember.

However, when we speak about the

There are landlords and there are landlords. Some are what we call “accidental” landlords, who decided to let their property as an alternative to selling. Others are somewhat inadequately regarded as “amateur” landlords, who have a single investment property.

However, it is “portfolio” landlords who make up the majority of our clients. A portfolio landlord

Whilst both gas and electricity can be lethal, from a landlord’s perspective, the law relating to gas safety is more stringent than it is for electricity with substantial fines or even imprisonment for of the breaches of the Gas Safety (Installation and Use) Regulations 1998. These regulations impose a duty on landlords to use a

Possibly prompted by a lack of supply, increasing numbers of home movers are renting as an interim measure prior to buying their next property.

If you are selling, it can be tempting to stay put until the right house comes onto the market. However, many people who have done this, and who find the right

Welcome to the April 2021 Property Market Comment. The government’s decision to extend both the stamp duty holiday and the furlough scheme, as well as their new guarantee for high loan-to-value mortgages, have played their part in reducing uncertainty and boosting confidence.

Add to that the easing of lockdown, world-class rollout of the vaccine, impressive

Welcome to the March 2021 Property Market Comment, following a very eagerly awaited budget. Fortunately for the property market, there was no immediate bad news at all, especially in respect of the much-publicised Stamp Duty deadline.

In a nutshell, nine months ago, the government sought to bolster the economy by helping the property market, by

David Clarke is an award-winning independent family company established for over 50 years.